Feedback From Kiwetinohk Energy’s Eastern Canada Tour

A quick update for you following a very busy time last week for us hosting Kiwetinohk Energy (KEC-T $12.97 Mkt Cap $570 million) in Montreal, Toronto and Halifax.

Alexis de la Renaudiere, Pat Carlson and Jakub Brogowski in Montreal

Three key things stood for us in the preliminary feedback from the IAs and family offices we met:

1. Respect and kudos for both CEO Pat Carlson and CFO Jakub Brogowski: Pat for his track record and forward-looking vision with KEC’s green energy projects; and high marks to Jakub for his ability to take a story with many moving parts to it and underline the key aspects that our retail IA clients will focus on.

2. The path to profitability and catalysts that will be a key support the shares going higher will be driven in a big way by the green energy projects – with a key advantage to Kiwetinohk being the advanced status of their project pipeline. (Note: Kiwetinohk made a very significant hire last August by bringing on Fareen Sunderji to head up its power division – Aug 24, 2023 - Power President Announcement (kiwetinohk.com)

3. Liquidity – an issue pointed out by everyone, but not a major concern for those wanting to take initial positions nor does it preclude accumulating larger positions in the months ahead. It’s clear that any future offering of shares from the company which has a retail component to it would be very well received.

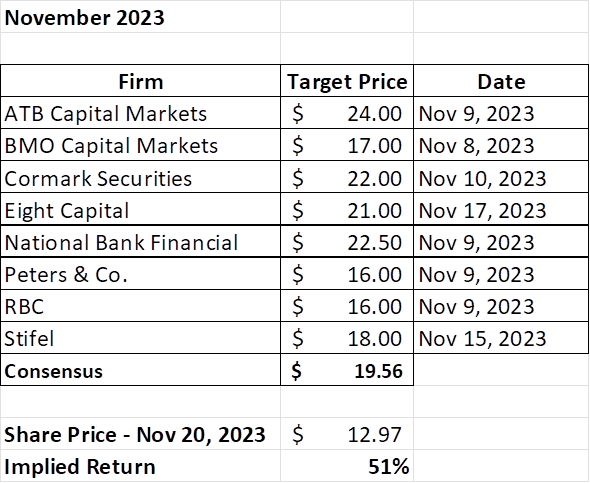

While Pat and Jakub were on the road with us, two more research reports were released:

on Thursday of last week Stifel launched an Initiating Coverage report with a “Buy” rating and a $18 target; and

on Friday Eight Capital also initiated coverage with a “Buy” recommendation and a $21 target.

Two key takeaways from these reports were these two bullets from the research reports, which addresses points #2 and #3 above:

“KEC’s power/green energy strategy exposes investors to potential key monetization & re-rating events as well as potential upside to revenues in the event the company retains an interest in its gas fired power plant opportunities.” Eight Capital

“We find the shares significantly undervalued, even if zero value is ascribed to the Green Energy business, due at least in part to very low trading liquidity (~74% of shares are held by two investment firms), but that may change going forward.” Stifel

Here’s a complete summary of KEC’s research coverage – if you’re interested in the details of the Alberta power grid as well, Stifel wrote an in-depth and easy-to-read overview.

Thanks for your continued interest and support.

Greg Stumph

President