YOU SHOULD KNOW

TRENDS. CATALYSTS. NEWS. ALL AT YOUR FINGERTIPS.

You Should Know - Recap

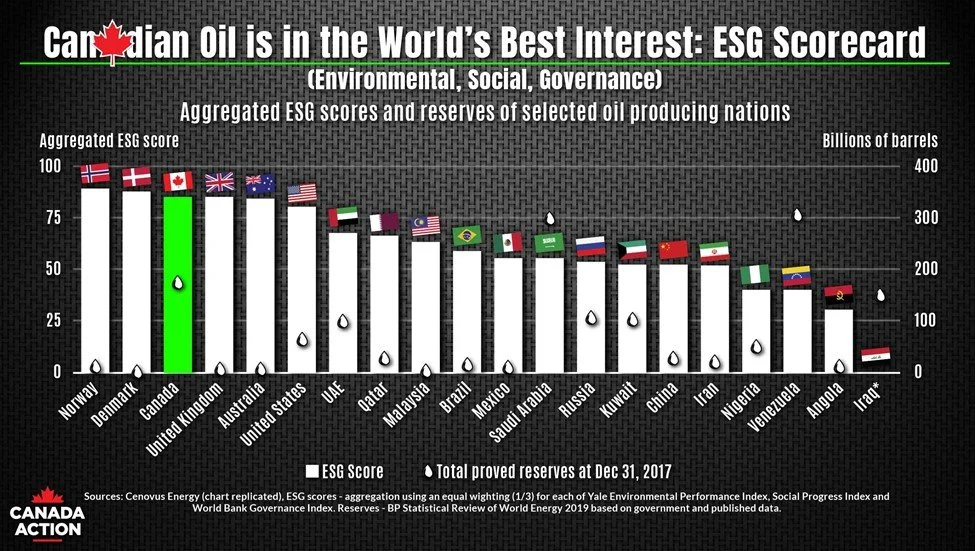

The World Needs More Canada.

There’s never been a time when the world – and Europe, especially - needs more of Canada than today.

War in Ukraine. Inflation is at record highs. Climate change wreaking havoc. Supply chain snarls. A shortage of goods, services, and workers around the globe, with the full effects of the pandemic still playing out.

Against this backdrop, the need to gain secure access to the products that make the world run has focused corporations to look at alternative business solutions.

Investing in Canadian Capital Markets: More than just oil and gas.

Investing opportunities are abundant in Canadian capital markets. Utilizing our two main equity markets, the Toronto Stock Exchange and the TSX Venture Exchange, investors in Europe can access a multitude of securities in specific industry sectors.

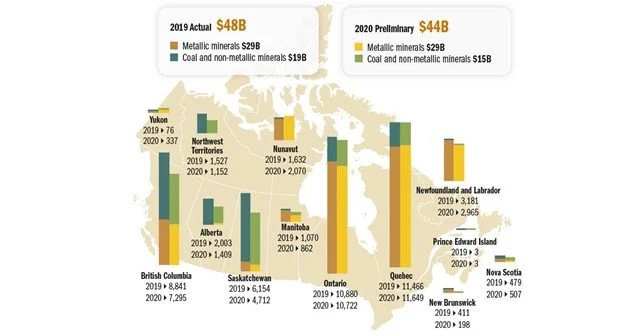

Canada is a global leader in energy, energy transition, critical materials, and precious metals for public companies

Geographically, Canada is the second largest country in the world, with a relatively small population of 38 million. It’s a country that prides itself on stability. In our view, several Canadian-specific features are the differentiating factors:

The Energy Transition: Here is what you need to know now.

What do lithium, the Rogers outage, and a small city in Prince Edward Island have in common? They’re all part of the global energy transition movement that has Canada, along with the U.S. and European Union, committing to a net-zero electricity grid by 2035. The United States just agreed to fund their climate mandate. This is exciting for the United States, and frankly Canada.

Like many other countries in the Paris Agreement, leveling up Canada’s energy economy will be essential to achieving this target. As a result, the country’s energy transition industry is going to see a monumental boom in the next few decades.

Be Bold. Think Big.

As we head into the long weekend, I thought I’d pass along three items I thought You Should Read when you find a moment:

Lukas Lundin: tip of the hat to Peterson Capital client Eira Thomas, CEO of Lucara Mining (LUC-$0.62 Mkt Cap $281 million) for writing a very poignant and meaningful news release on Wednesday announcing Mr. Lundin’s passing away.

Eira and her team put together a testimony that highlighted Mr. Lundin’s obvious contributions to the mining industry and then went deeper into how he impacted Lucara from both a professional and personal level. They wrote about “a man was never afraid to swim against the tide once the value of an opportunity became apparent”. They noted his “commitment to innovation and willingness to take risks”, his “energy and passion for living life to its fullest”

A Golden Opportunity or A Gold Rush Amid a Bearish Market?

We at Peterson Capital are always looking for the next great opportunity. We follow the markets closely and while there have been a lot of downs recently there have been bright spots. We wanted to share what You Should Know about some exciting projects in which Peterson Capital clients are involved. Here are two featured companies working at opposite ends of the world that we want you to know about.

Great Companies In These Difficult Times.

We hear it every day; markets are demanding. They are brutal. Unfortunately, today's equity markets are tough on our Investment Advisors, especially their support teams.

The companies below have one thing in common, they are working hard to provide future value. Peterson Capital’s clients work hard every day to reach this success. Here are a few that you should look at.

Great Advice for “Yucky Markets”.

Earlier this week I came across an outstanding letter written by the CEO and President of a major (5,000 employees) US securities firm, Jefferies Financial Group.

I thought you should know about this letter if you haven’t already seen it. In 10 succinct and well-written points, it addresses many key issues that we’re all facing now in these “yucky” markets. I reviewed it on a call with our Peterson Capital team this week, as it resonated with our platform as a business, and with each of us on an individual level.

Lessons from Europe.

If you are following the Peterson Capital LinkedIn page, you’ll see that I spent all of last week with our Euro team in Monaco, Geneva, Paris, and Madrid.

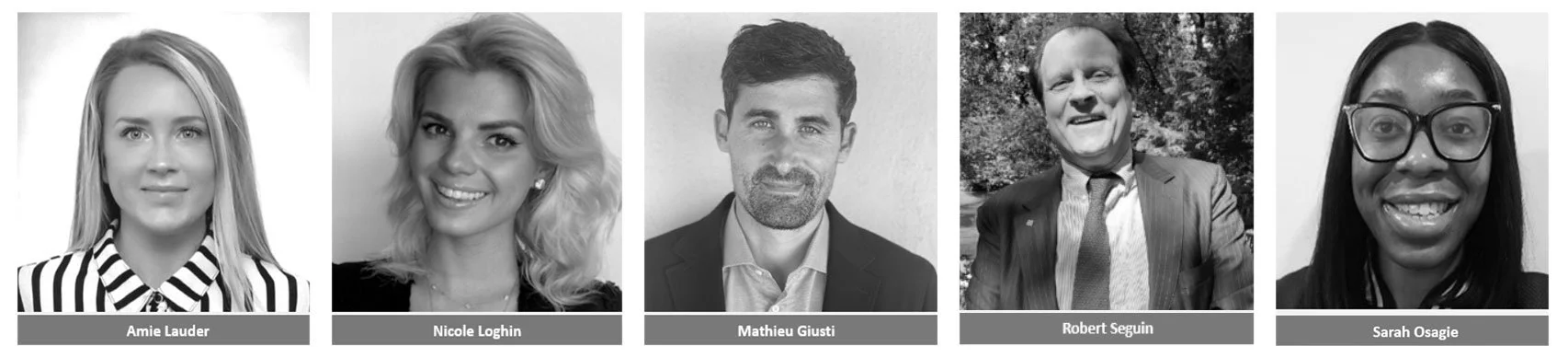

We launched our European office last November, and the team led by Amie Lauder has done an amazing job of helping us further develop relationships across the continent. Mathieu Guisti, Nicole Loghin, and our partner Robert Seguin, of Westmount Capital, have rapidly established a strong network of family offices and funds interested in hearing more about our clients.

E3 Lithium Teams Up With Imperial Oil

On June 23, 2022, E3 Lithium signed a deal with Imperial forming a strategic agreement on a lithium pilot project in Alberta. This project is a collaboration with Imperial supporting E3's Clearwater project which will draw lithium from under the Leduc oil field Imperial's historic discovery that first launched major oil and gas development in Western Canada.

How New Zealand’s All Blacks can help your team through brutal markets

Today’s brutal equity markets are tough on our Investment Advisors - and especially their support teams. They are flooded with a myriad of things to do when the quote screens are dark red: answering calls; sending out statements; reviewing portfolios; making market decisions; helping clients stay on track with their strategy; keeping up with research and compliance; hand-holding nervous clients.

Bill 96 and Your Business

The Quebec government passed a very significant piece of legislation on Tuesday, May 24, 2022. This legislation will affect all of us in our business relationships with clients, colleagues, or companies in Quebec.

Show us the MVPs on your team!

We all know how important your teams are. If you’re an Investment Advisor or the CEO of a public company, you’re not on the ice alone. A team backs you up, and you’re only as good as the team you have around you.

Our message to IAs and public company clients during turbulent markets.

The past few weeks, and especially the last several days, have been hard on everyone in the markets.

We know that – we hear it from you, and we’re feeling your pain.

Blue Sky in Current Markets? Yes!

Nomad Royalty has been tantalizing the markets with its compelling story culminating in a takeover bid by Sandstrom this week worth C$755 million.

Peterson Capital Spotlights the News Makers of the Week.

Peterson Capital takes pride in our activities on behalf of our clients and global communities. Here are a few You Should Know highlights from the week capped off with our VP in Atlantic Canada, David Kean and his support for the Ukrainian Refugees arriving in Eastern Canada this month.

Peterson Capital Spotlights Green Energy on Earth Day 2022

Peterson Capital recently toured in Europe with great success. We take pride in all the clients we represent, whether in mining, oil, and gas, green energy, or special situations. Our tour in early April with Green Impact Partners was outstanding.

Peterson Capital Europe Platform Expands

Our Team in Europe: Last week, Amie Lauder, who opened an office for us in France in December of last year, hosted a week in Europe accompanied by our Chair, Rick Peterson. Since then she has brought into the fold two more members of her Europe-based team: Nicole Loghin – who was formerly based with us in Toronto - and Mathieu Giusti, a native of Aix-en-Provence. You can find bios of all our team members

Blue Sky Visible Through The Fog of War

There a huge bear market out there in small cap world outside of energy and commodities. That’s a given – we all know that.

War in Ukraine. Rising commodity prices. Interest rate hikes. The market’s “wall of worry” looking steep, high and ugly.

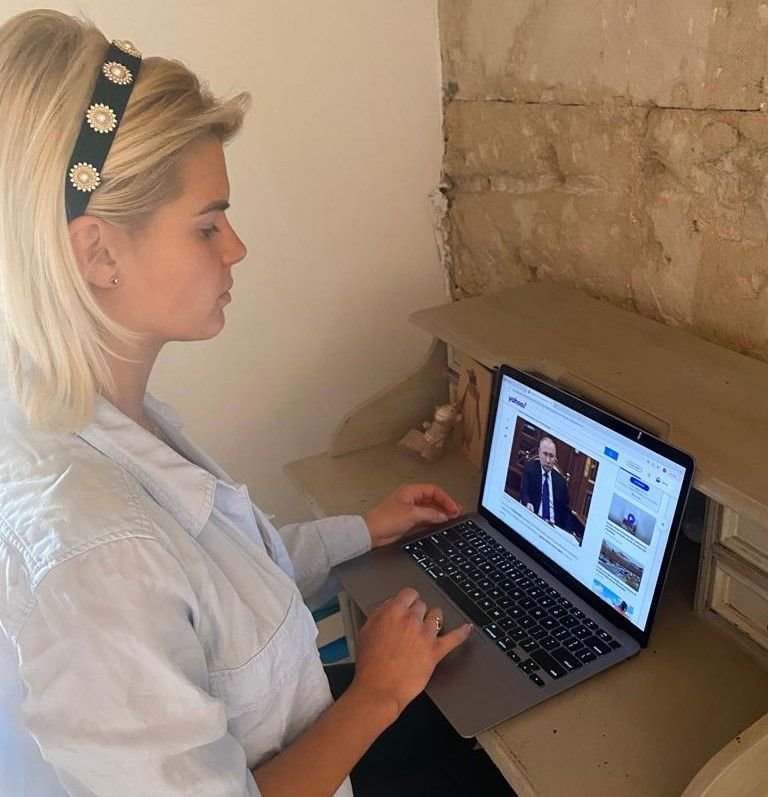

Ukraine, Spain, Montreal and Zoom Screens

This has been an eventful week for our team members across Canada and into Europe. Here are three highlights we thought You Should Know about: